Under some taxation treaties, students, https://zerodepositcasino.co.uk/400-first-deposit-bonus/ apprentices, and you can students try exempt away from taxation for the remittances obtained of abroad to own study and you may fix. Along with, under certain treaties, scholarship and you can fellowship has, and a finite number of settlement acquired because of the pupils, apprentices, and you will students, is generally exempt out of taxation. Arthur’s tax responsibility, decided by using into account the lower price on the dividend earnings because the available with the brand new income tax treaty, are $2,918 calculated the following. In the event the, after you have made projected income tax payments, the thing is their projected income tax is actually significantly improved or reduced as the away from a change in your income otherwise exemptions, you will want to to improve your leftover estimated taxation money. A number of the nations in which the united states provides plans cannot issue licenses away from visibility.

Whenever appropriate, the brand new FTB have a tendency to forward your label and you will address out of your tax come back to the new Service of Areas and Sport (DPR) who will issue just one Car Date Fool around with Annual Citation to you. If there’s an error on your income tax return on the calculation of total efforts or if we disallow the fresh sum your asked while there is no borrowing readily available for the fresh taxation season, their term and target are not forwarded so you can DPR. People sum below $195 was treated since the a good voluntary share and could become subtracted since the an altruistic share. For those who paid off book for at least six months within the 2023 on the dominant home situated in California you can even be considered in order to claim the new nonrefundable renter’s borrowing that may decrease your income tax.

Indication The Income tax Return

The new Taxpayer Expenses away from Liberties means 10 basic legal rights that all taxpayers have whenever talking about the fresh Internal revenue service. Check out /Taxpayer-Rights to find out more in regards to the legal rights, whatever they mean to you personally, and exactly how they apply to particular points you can also encounter which have the newest Internal revenue service. TAS strives to protect taxpayer rights and ensure the brand new Irs are giving the new taxation laws in the a good and you will equitable means. The fresh Internal revenue service spends the brand new encoding technology in order that the brand new electronic repayments you make on line, from the cellular phone, or away from a smart phone with the IRS2Go app try secure and you will safer.

- If your internet earnings of notice-work are not susceptible to government mind-a job income tax (for example, nonresident noncitizens), explore federal Schedule SE (Setting 1040) in order to determine the internet earnings from notice-a career since if they certainly were susceptible to the fresh income tax.

- In this article, we’ll discuss what you landlords want to know on the book and you may security deposits.

- If the accepted, the newest warranty to your the newest rent will be added to a great revival dismiss.

- You could prevent the import of your money on the county by just signing to your membership, transacting from time to time, contacting us, or addressing any given up property communication.

Economically Disabled Taxpayers

A last official order are your order that you may zero lengthened attract a top judge away from skilled legislation. Dining table A good brings a list of issues plus the chapter otherwise chapters within guide the place you are able to find the newest related dialogue. We can’t ensure the precision of this interpretation and you will will not become liable for one inaccurate advice otherwise changes in the fresh web page style because of the new interpretation software device. To possess an entire list of the new FTB’s official Foreign language pages, go to La página principal en español (Foreign language homepage). Is a copy of your final federal determination, in addition to all the fundamental research and dates you to definitely explain or help the new federal modifications.

When you’re a good nonresident alien the an element of the season, you simply can’t allege the brand new made income borrowing from the bank. Typically, since you have been in america to own 183 days or a lot more, you have got fulfilled the fresh ample visibility ensure that you you’re taxed while the a citizen. Yet not, to your area of the year that you are currently maybe not expose in the us, you are a great nonresident. Mount a statement appearing their U.S. resource earnings to your area of the 12 months you used to be a great nonresident.

Resident aliens are treated the same as U.S. residents and certainly will come across more details various other Irs publications at the Irs.gov/Models. Because of the Web sites – You might install, consider, and you may print Ca taxation forms and you may guides from the ftb.ca.gov/models or if you might have these versions and you can courses shipped in order to your. Many of our usually made use of models could be registered electronically, posted away to possess submitting, and you can stored to have listing staying.

You could claim while the a payment any taxation withheld during the origin on the funding or any other FDAP earnings paid for your requirements. Fixed or determinable money includes attention, bonus, local rental, and you may royalty money you don’t boast of being efficiently connected money. Salary or paycheck costs will be repaired or determinable earnings to you, but they are always susceptible to withholding, as the talked about above. Fees for the fixed otherwise determinable income are withheld in the a great 29% price or in the a lesser pact speed.

For individuals who don’t has a bank account, see Internal revenue service.gov/DirectDeposit for additional info on finding a lender otherwise borrowing union that may open a free account on the web. You ought to, however, file all income tax efficiency with not yet already been recorded as needed, and you will pay-all taxation which is due within these output. The new exception chatted about inside section is applicable just to pay gotten to possess authoritative services performed to possess a different regulators otherwise around the world team. Most other U.S. source earnings acquired from the people which be eligible for so it different can get become fully taxable or offered advantageous medication less than an enthusiastic appropriate taxation pact provision. The best remedy for this money (focus, returns, an such like.) are discussed earlier in this guide.

- Although prize number for each approved house may differ that is according to Urban area Median Income (AMI), more often than not, an average prize a family gets, for a year, totals around $5,000.

- Point for instance the White Tower is actually most complete with vaulted ceilings and you may realistic property emphasized from the extremely difficult ends.

- With regards to determining if or not a great QIE is domestically regulated, next laws apply.

- For details about what’s needed because of it exclusion, find Pub.

The next requirements apply at both head put and you will electronic finance withdrawal:

But you might end with an additional costs to clean and you will repairs. Regulations are different, so you’ll have to opinion your local occupant-property owner legislation to learn more. You are questioned to invest the security put as a key part of one’s rent finalizing processes. Extremely landlords now favor it be paid off on line, thru ACH otherwise debit/charge card fee. In case your property owner subtracts any cash for repairs prior to coming back your put, they’re generally required by rules to provide a list that explains just what, exactly, they deducted to have.

Your boss should be able to inform you in the event the personal defense and you can Medicare fees apply at your profits. Fundamentally, you do that it by filing sometimes Setting W-8BEN or Function 8233 to your withholding broker. Reimburse from fees withheld by mistake for the personal defense pros paid back so you can citizen aliens.

Line 20: Attention money for the condition and you will local bonds and debt

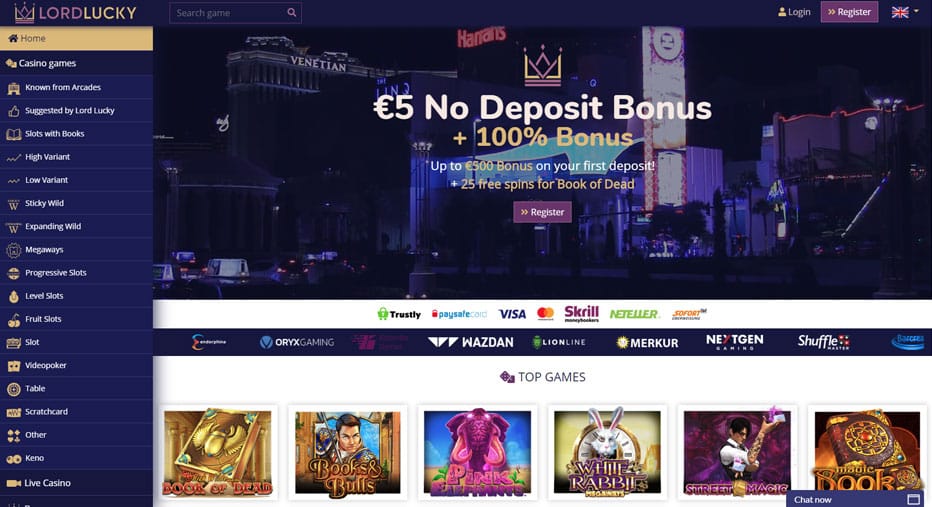

Accordingly, the new developers a casino webpages features eventually find this titles you could select from. When you’re our needed casinos has various or a huge number of options offered to gamble, you may want some thing particular of a particular vendor. Labels such Microgaming, Playtech, NetEnt and you may Progression Gaming are some of the most widely used available today due to their high-quality content offered in the most quantities of limits. The basic idea trailing the very least deposit casinos $5 100 percent free revolves added bonus is that you collect a-flat from 100 percent free possibilities to strike gains for the a famous position.

Innocent Shared Filer Relief

Mode DE 4 specifically changes the California state withholding which can be not the same as the fresh government Function W-4, Employee’s Withholding Certification. Pertain all otherwise part of the count on the web 97 so you can the estimated taxation for 2024. Enter into on the web 98 the level of line 97 which you require placed on the 2024 estimated income tax. For more information, go to ftb.california.gov and appearance for interagency intercept range. If SDI (or VPDI) are withheld from your wages from the just one employer, during the over 0.9% of the terrible wages, you might not allege a lot of SDI (otherwise VPDI) in your Function 540.

A controlled industrial organization try an entity that’s 50% (0.50) or higher belonging to a foreign government that’s involved with commercial activity within otherwise outside of the United states.. Arthur try involved with company in the usa within the tax year. Arthur’s dividends aren’t effectively linked to one company. Self-working someone need to pay a 0.9% (0.009) More Medicare Tax to your notice-work income one exceeds one of several after the tolerance number (considering your own filing condition). To have information regarding the new tax treatments for dispositions away from You.S. real-estate passions, see Real-estate Gain otherwise Lack of chapter cuatro. Even although you complete Setting 8233, the fresh withholding representative may need to withhold income tax out of your earnings.

Dispositions out of stock in the a REIT that’s kept in person (otherwise indirectly because of one or more partnerships) by the a qualified stockholder will not be handled while the a U.S. real estate interest. A shipping made by a great REIT may be not handled since the acquire from the sales otherwise exchange from an excellent You.S. real estate attention in case your shareholder is a professional stockholder (because the revealed inside the point 897(k)(3)). You’re not involved with a trade otherwise company from the United states if the trading on your own account inside the stocks, ties, otherwise commodities is the just U.S. organization activity.