Because of the two-fold effect of business transactions, the equation always stays in balance. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). In worst-case scenarios, the company could go bankrupt as a result of mishandling finances using inaccurate numbers due to an unbalanced equation. So, let’s take a look at every element of the accounting equation. This transaction brings cash into the business and also creates a new liability called bank loan.

Our Team Will Connect You With a Vetted, Trusted Professional

- Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability.

- Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son.

- Additionally, you can use your cover letter to detail other experiences you have with the accounting equation.

- A lender will better understand if enough assets cover the potential debt.

- These are fixed assets that are usually held for many years.

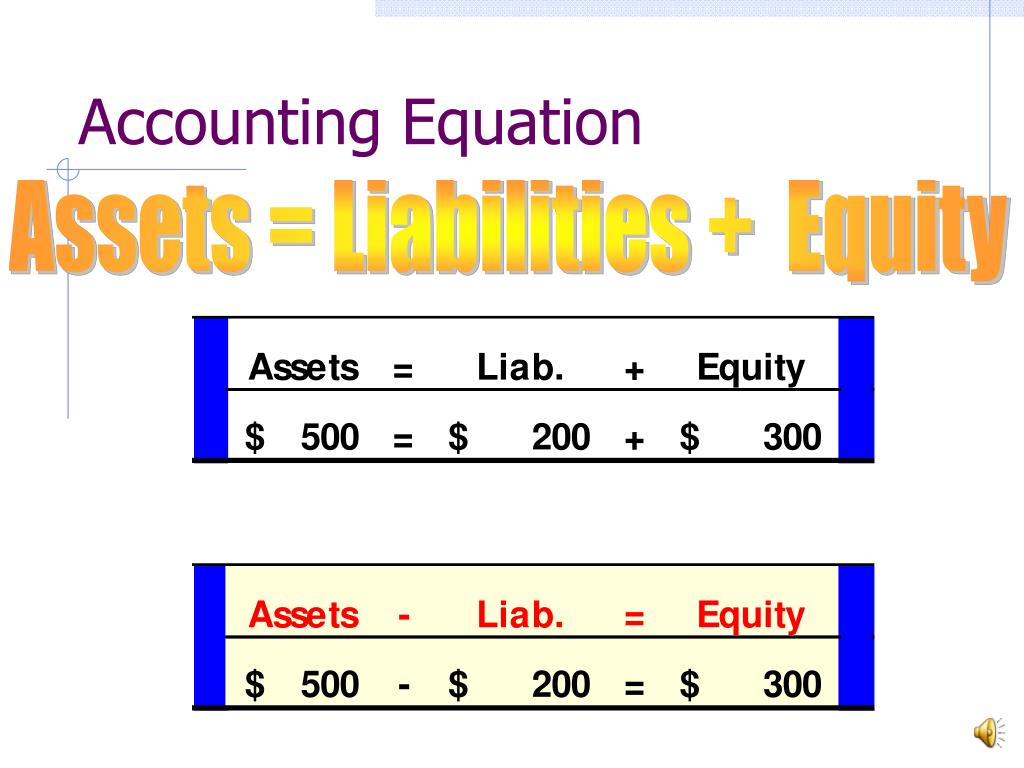

The Accounting Equation states that assets equals the total of liabilities and equity. At the same time, it incurred in an obligation to pay the bank. When the total assets of a business increase, then its total liabilities or owner’s equity also increase. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. On the other hand, double-entry accounting records transactions in a way that demonstrates how profitable a company is becoming.

Balance Sheet and Income Statement

And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. Analyze a company’s financial records as an analyst on a technology team in how do i create a new category or subcategory this free job simulation. The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years.

How to Build Conflict Resolution Skills: Case Studies and Examples

If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. As its name implies, the Accounting Equation is the equation that explains the relationship of accounting transactions.

Purchase of Equipment in Cash

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Assets

Still, you’ll likely see this equation pop up time and time again. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point. For example, if a business signs up for accounting software, it will automatically default to double-entry. This number is the sum of total earnings that were not paid to shareholders as dividends. Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. Equity includes any money that has been invested into the company by shareholders as well as retained earnings which have not yet been paid to shareholders as dividends.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

The accounting equation matters because keeping track of each transaction’s corresponding entry on each side is essential for keeping records accurate. To illustrate how the accounting equation works, let us analyze the transactions of a fictitious corporation, First Shop, Inc. There are different categories of business assets including long-term assets, capital assets, investments and tangible assets. They were acquired by borrowing money from lenders, receiving cash from owners and shareholders or offering goods or services.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. This simple formula can also be expressed in three other ways, which we’ll cover next. At first glance, this may look overwhelming — but don’t worry because all three reveal the same information; it just depends on what kind of information you’re looking for. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it. The 500 year-old accounting system where every transaction is recorded into at least two accounts. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. Receivables arise when a company provides a service or sells a product to someone on credit.