Articles

Correctly, you are a citizen for conversion income tax motives even when you might not be a resident to possess tax motives. Also add one to part of the government amount which you gotten when you had been a citizen. People passive activity loss should be recalculated as you filed independent federal productivity for your citizen and you will nonresident periods. So you can compute this count, fool around with a duplicate away from government Plan D (Setting 1040) since the a good worksheet, and the federal provisions to own figuring funding progress and losses merely to possess transactions that have been away from New york offer. When you have a net money losses for brand new York Condition objectives the loss is bound to $3,100000 ($step one,500 if you are married and you will submitting individually) on your own Ny State return. You should remove one harmony from a loss of overabundance the quantity stated on your own 2024 return as the a good carryover losings for the output for senior years.

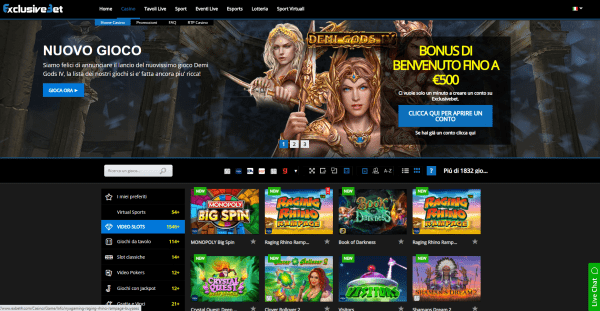

You can begin to experience now which have a tiny deposit since the low because the 5 dollars. The highly outlined local https://mrbetlogin.com/big-bang/ casino ratings and you can proprietary score system are created to really make it so easy to pick out and this alternative of a handful of extremely ranked local casino web sites tend to complement you the finest. As well, picking right up special extra also offers to own small minimal places hasn’t been simpler, to help you focus on a direct improve for the local casino membership. View the needed checklist and select a good 5 dollars put gambling establishment that fits all of your demands.

Up-to-time information affecting your income tax return

Aliens are known as nonresident aliens and citizen aliens. It publication will assist you to influence their condition and give you advice you will need to document their U.S. taxation go back. Citizen aliens are generally taxed to their global money, just like U.S. people. Nonresident aliens is actually taxed only on their earnings of source inside the us and on particular earnings linked to the new run from a trade or company in the united states.

Multiply the number your entered by pre-published buck matter and you can enter the effect. Merely nonresident aliens that You.S. nationals; residents away from Canada, Mexico, otherwise South Korea; or students and you will team apprentices away from India who qualify for professionals under Blog post 21(2) of one’s taxation treaty having India can be claim the child tax borrowing from the bank. Just one (or lifeless individual) who is (otherwise are) an excellent nonresident noncitizen of your own All of us for estate and gift income tax intentions may still has U.S. home and you will gift income tax submitting and fee debt. The new determination out of if or not one is an excellent nonresident noncitizen for You.S. house and you can provide income tax aim differs from the newest determination from if or not you were a good nonresident alien for You.S. government income tax aim. Property and gift income tax factors try outside the extent away from that it publication, but information is on Irs.gov to choose if people U.S. property otherwise provide tax considerations can get apply to your role. Aliens are classified as resident aliens and you will nonresident aliens.

Membership disclosures

Do not matter the changing times on which you travel to work in the united states from your own household in the Canada or Mexico for many who frequently drive away from Canada or Mexico. You are considered to travel regularly for individuals who commute to be effective in the united states on the over 75% (0.75) of your own workdays during your functioning months. Standards for taxpayers who expatriated ahead of June 17, 2008, are not any lengthened chatted about regarding the Recommendations to own Function 8854 or Bar. To own information regarding expatriation just before Summer 17, 2008, understand the 2018 Recommendations to have Mode 8854, and section 4 of your 2018 Club. For those who begin the newest commitment, your own resident position is recognized as being quit after you file either of your pursuing the documents with your Long lasting Citizen Cards (eco-friendly credit or Mode We-551) connected to the brand new USCIS otherwise a good You.S. consular officer. Visit Irs.gov/Models to help you obtain newest and you may earlier-12 months models, recommendations, and courses.

And using the same legislation because the You.S. owners to determine that is a depending, under the tax pact having South Korea, the little one must have existed for the nonresident alien regarding the You at some time in the tax season. A great nonresident alien basically do not document because the married filing jointly. However, a good nonresident alien that is married to an excellent You.S. resident otherwise resident can choose becoming managed while the a citizen and document a mutual get back to the Function 1040 otherwise 1040-SR. Unless you make the choice in order to file as one, document Form 1040-NR and use the newest Income tax Table column or perhaps the Tax Calculation Worksheet for married somebody processing independently.

RentCafe Way of life Suite Brochure

Find out what suitable assets administration systems will do to transform your business. When you yourself have questions regarding the city’s brief book and power guidance software, get in touch with the city’s COVID System Professional, Laura O’Brien, in the Not all the eligible homes qualify for the newest move-in the advice, eviction avoidance, and you will limited month-to-month subsidy. Households which might be currently getting subsidized advice aren’t eligible for the fresh minimal monthly subsidy but can qualify for disperse-in the guidance. When you have obtained RMAP advice in past times, you’re ineligible. So you can estimate month-to-month subsidy number, your family’s revenues and monthly lease are used.

Receive and send money people-to-member of the newest U.S.

The total retirement and annuity money exclusion said by the decedent plus the decedent’s beneficiaries do not go beyond $20,100. If you recorded a joint government come back and something spouse is actually a north carolina State citizen as well as the almost every other is actually a nonresident or area-12 months citizen, you are required to document separate Ny Condition productivity. The fresh nonresident or area-seasons resident, if required to file a new york State return, need to explore Function They-203. Although not, for many who one another like to file a shared Ny County return, fool around with Form They-201; both partners’ money was taxed because the complete-year citizens of brand new York Condition. A taxpayer need declaration all taxable money obtained otherwise accrued throughout the the newest season (from Jan. step one due to Dec. 31) tax months. The newest Pennsylvania Agency out of Money comes after the internal Funds Solution (IRS) deadline for processing efficiency.

Citizen aliens just who formerly had been real residents of Western Samoa otherwise Puerto Rico try taxed with respect to the laws and regulations to own citizen aliens. But not, you could make the choice because of the filing a combined amended return to the Mode 1040-X. Attach Function 1040 otherwise 1040-SR and you can go into “Amended” along the the top of corrected get back.

To find which different, you or your own representative have to provide the after the statements and you may guidance to your Administrator or Commissioner’s delegate. You’ll have to spend the money for penalty for those who submitted it kind of get back otherwise distribution based on a great frivolous position otherwise a want to slow down or restrict the fresh management of government tax laws and regulations. This includes modifying or striking-out the newest preprinted words over the space delivered to the trademark.

All of our overdraft payment to own User checking profile try $35 for every items (whether the overdraft is by take a look at, Atm withdrawal, debit card exchange, or any other electronic setting), and now we costs only about about three overdraft charge per team date. Overdraft charge aren’t appropriate to pay off Access Financial profile. Please be aware your rating given below this service is for informative aim and may also not be the new rating utilized by Wells Fargo to make borrowing behavior. Wells Fargo talks about of numerous what to determine the borrowing from the bank possibilities; therefore, a particular FICO Get or Wells Fargo credit rating does not be sure a specific loan speed, approval away from that loan, otherwise an improvement to the a charge card.

- But not, the procedure of get together deposits and you will controlling devoted membership can make a demanding workload, compelling of numerous landlords to adopt shelter deposit options one remove administrative weight.

- Inability to help you quick statement and you can spend the money for fool around with income tax due could possibly get result in the research of great interest, punishment, and you may charge.

- You also might want to favor a credit union if you have trouble with conventional financial features or requirements.

- For individuals who wear’t feel the full security put number or you wear’t wanted your money trapped from the deposit on the identity of your own lease, you have got a few options.

- Required Digital Payments – You are required to remit all of your money digitally when you generate an offer otherwise expansion fee exceeding $20,100000 or if you document a unique come back having a complete income tax accountability more than $80,100.

State-by-state variations out of security deposit desire laws

You can even getting subject to a punishment of $50 unless you offer your own SSN otherwise ITIN in order to another individual if it is required on the money, a statement, or another document. If there is any underpayment away from income tax in your come back due in order to con, a penalty from 75% of one’s underpayment on account of con will be placed into your taxation. You would not have to pay the fresh punishment if you’re able to show that you had reasonable to have not paying the taxation promptly. Civil and you may violent penalties are provided to own neglecting to document a statement, processing research which has issue omissions otherwise misstatements, otherwise submitting a false otherwise fraudulent declaration.

To learn more, find Features Performed to have International Workplace in the chapter step 3. Thus their worldwide earnings is actually subject to You.S. taxation and really should become advertised on their U.S. taxation return. Earnings away from citizen aliens is subject to the brand new graduated income tax cost you to affect U.S. owners. Resident aliens utilize the Tax Desk otherwise Taxation Computation Worksheets discover from the Instructions for Form 1040, and that connect with U.S. citizens.

Earnings repaid to help you aliens who are residents away from American Samoa, Canada, Mexico, Puerto Rico, or perhaps the U.S. While you are qualified to receive some great benefits of Article 21(2) of your United states-India Tax Treaty, you can even allege an extra withholding allocation for the simple deduction. Discover Withholding on the Scholarships and you can Fellowship Gives, later, for how in order to fill out Mode W-cuatro for individuals who discover a good U.S. origin scholarship or fellowship give that is not a charge for characteristics.