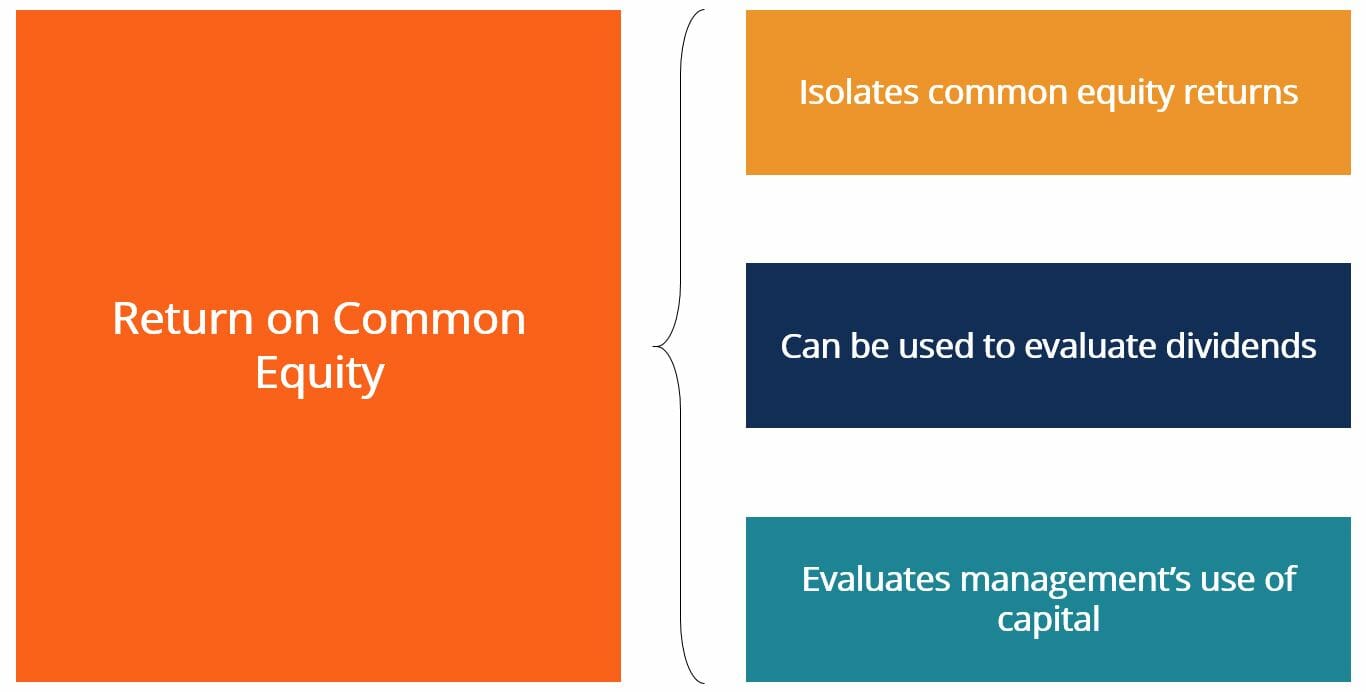

It indicates management’s efficiency in converting shareholders’ investments into earnings, which can be a positive sign to investors looking for companies with strong operational capabilities. Return on equity is a common financial metric that compares a company’s income to its total shareholders’ equity. Return on Equity (ROE) is an important financial metric that can be used to gauge a company’s profitability and efficiency in generating profits from the common shareholders’ investments. ROCE indicates the proportion of the net income that a firm generates by each dollar of common equity invested. Generally, investors have greater confidence in companies with a high and sustainable ROCE than in growth-oriented companies that cannot sustain growing returns on common equity. Corporate capital allocation decisions unrelated to core operations (e.g. preferred dividends, share repurchases) can significantly impact the ROE.

Return on Average Capital Employed (ROACE)

Emily Guy Birken is a former educator, lifelong money nerd, and a Plutus Award-winning freelance writer who specializes in the scientific research behind irrational money behaviors. Her background in education allows her to make complex financial topics relatable and easily understood by the layperson. She is the author of four books, including End Financial Stress Now and The Five Years Before You Retire. Taken together, ROE and ROA can help you determine how well a company is making use of its debt. For instance, while ROE will almost always be higher than ROA when a company has taken on debt, if the difference is huge, this could suggest the company is not making good use of its borrowed dollars.

What Is a Good ROE?

However, it is important to consider the limitations of ROCE and analyze it in conjunction with other financial metrics to gain a comprehensive understanding of a company’s performance. Comparing Return on Equity (ROE) among different industries reveals the varying levels of profitability and financial health that can exist aca frequently asked questions va, affordable care act and you across the economic spectrum. A financial metric, ROE, fundamentally measures how effectively a company uses investors’ funds to generate profits. For instance, technology firms may demonstrate higher ROE ratios than utility companies, indicating a more robust potential for growth and returns on equity in the tech industry.

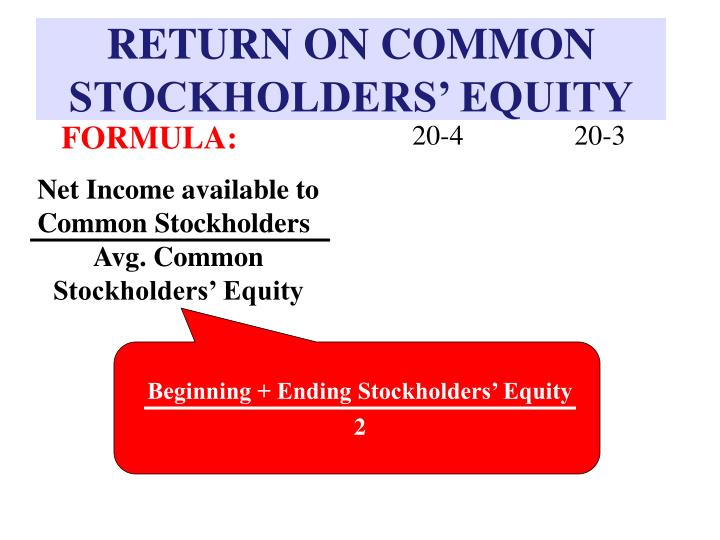

Sustainable Growth Rate

In our example, for every dollar of common shareholders’ equity, TechCo generates 20 cents of profit, while HealthInc generates 22.4 cents of profit. The average common equity is determined by taking the sum of the beginning and ending common stock equity for a period and dividing it by two. By expressing the net income as a percentage of the average common stockholders’ equity, investors gain a clear picture of the return generated on their investments. In summary, return on common shareholders’ equity ratio is a useful metric that can be used to measure a company’s profitability and historical financial performance. Apart from measuring a company’s current profitability, the return on common stockholders’ equity ratio can also be used to evaluate the historical financial performance of a business over a period of time.

In addition, larger companies with greater efficiency may not be comparable to younger firms. A return on equity that widely changes from one period to the next may also be an indicator of inconsistent use of accounting methods. First, they identify a great business and then start looking at the share price to determine if it’s a good deal. Another approach is for a company to operate with more debt and less equity, which can make the ROE appear higher. However, it is important to note that the acceptable level of return on equity may vary from industry to industry.

How do I calculate ROE?

ESG factors may impact a company’s profitability and performance in the long run and provide insights into the company’s social and environmental impact. Investors may also adopt customized benchmarks for different industries and businesses to reflect the specific operational and economic conditions. That being said, investors want to see a high return on equity ratio because this indicates that the company is using its investors’ funds effectively.

- As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

- However, if a company has a net loss or negative shareholders’ equity, ROE should not be calculated.

- It begins with identifying the Net Income, typically located prominently on the income statement.

However, this strategy can also pose risks to the company’s financial health, especially if it takes on excessive debt that it cannot service. However, this strategy can have potential drawbacks for the company’s financial health, particularly if it takes on additional debt to fund the buyback. In this case, the amount of the preferred stock dividends for the relevant period would be subtracted from the firm’s net income (Net Income – Preferred Stock Dividends). A high ROE can also indicate a reliance on debt to fund operations and growth, which can pose risks to the company’s financial stability. In our modeling exercise, we’ll calculate the return on equity (ROE) for two different companies, Company A and Company B.

For such an endeavor, we can use the debt-to-capital ratio, which relates the interest-bearing debt to the shareholder’s equity (see debt to capital ratio calculator). Contrary to the ROE, a higher debt-to-capital ratio might indicate too much debt in the company’s capital structure. Because you’re interested in ROE, you might also want to check out other business calculators, such as the ROA calculator, which measures the profitability of a company in generating profit from its assets. The return on equity, or “ROE”, is a metric that represents how profitable the company has been, taking into account the contributions of its shareholders.

A common scenario is when a company borrows large amounts of debt to buy back its own stock. This can inflate earnings per share (EPS), but it does not affect actual performance or growth rates. Whether an ROE is deemed good or bad will depend on what is normal among a stock’s peers. For example, utilities have many assets and debt on the balance sheet compared to a relatively small amount of net income. A technology or retail firm with smaller balance sheet accounts relative to net income may have normal ROE levels of 18% or more.

Still, as a rule of thumb, rates that exceed the average for the company’s industry can be considered strong. Investors often compare a company’s ROCE against that of its peers to discern its relative performance. For instance, a high ROE might suggest exceptional efficiency in generating profits, yet this figure may be inflated. Companies with significant debt can exhibit elevated ROE levels because their equity base is smaller due to borrowing. It’s also important to consider that extraordinary items or one-time events can skew ROE, presenting an unsustainable performance snapshot.