Plus, the asset turnover ratio can come in handy when you’re looking into business funding. Interpreting the asset turnover ratio requires a nuanced approach, as the figure alone does not paint a complete picture of a company’s performance. Analysts must consider the context within which the company operates, including market conditions and the lifecycle stage of the business. For example, a mature company with established market presence might have a lower ratio compared to a growth-phase company rapidly expanding its sales with fewer assets.

Influencing Factors on Asset Calculation

In other words, Sally’s start up in not very efficient with its use of assets. To calculate the ratio in Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 total asset balances ($145m and $156m). We now have all the required inputs, so we’ll take the net sales for the current period and divide it by the average asset balance of the prior and current periods. Suppose a company generated $250 million in net sales, which is anticipated to increase by $50m each year.

I’m a Successful Small Business Owner: 3 Ways My First Job Prepared Me To Be an Entrepreneur

In contrast, a company that overinvests in underperforming assets will see how it adversely impacts the asset turnover ratio. By using this ratio, companies can evaluate their productivity in using assets that are on hand. A corporation must approach its business operations holistically and concentrate on finding methods to make more money with fewer assets if it wants to increase asset turnover.

What is a good total asset turnover ratio?

Total asset turnover ratio should be looked at together with the company’s financing mix and its net profit margin for a better analysis as discussed in DuPont analysis. If a company can generate more sales with fewer assets it has a higher turnover ratio which tells us that it is using its assets more efficiently. On the other hand, a lower turnover the elderly or disabled irs tax credit for 2021 details ratio shows that the company is not using its assets optimally. Companies with fewer assets on their balance sheet (e.g., software companies) tend to have higher ratios than companies with business models that require significant spending on assets. Several factors impact how companies calculate and interpret their asset turnover ratio.

Fixed asset turnover (FAT)

- This interplay between asset turnover and profit margins underscores the importance of looking at financial ratios in conjunction.

- For example, retail companies generally have higher asset turnover ratios because they sell products quickly and need fewer assets to generate sales.

- The asset turnover ratio is a financial metric that evaluates how effectively your business uses its assets to produce revenue.

- That’s because this ratio gives creditors a direct line of sight into whether or not your company is optimally managed.

- This metric is also used to analyze companies that invest heavily in PP&E or long-term assets, such as the manufacturing industry.

As with all financial ratios, a closer look is necessary to understand the company-specific factors that can impact the ratio. Such ratios should be viewed as indicators of internal or competitive advantages (e.g., management asset management) rather than being interpreted at face value without further inquiry. Hence, it is often used as a proxy for how efficiently a company has invested in long-term assets. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

What Is a Good Fixed Asset Turnover Ratio?

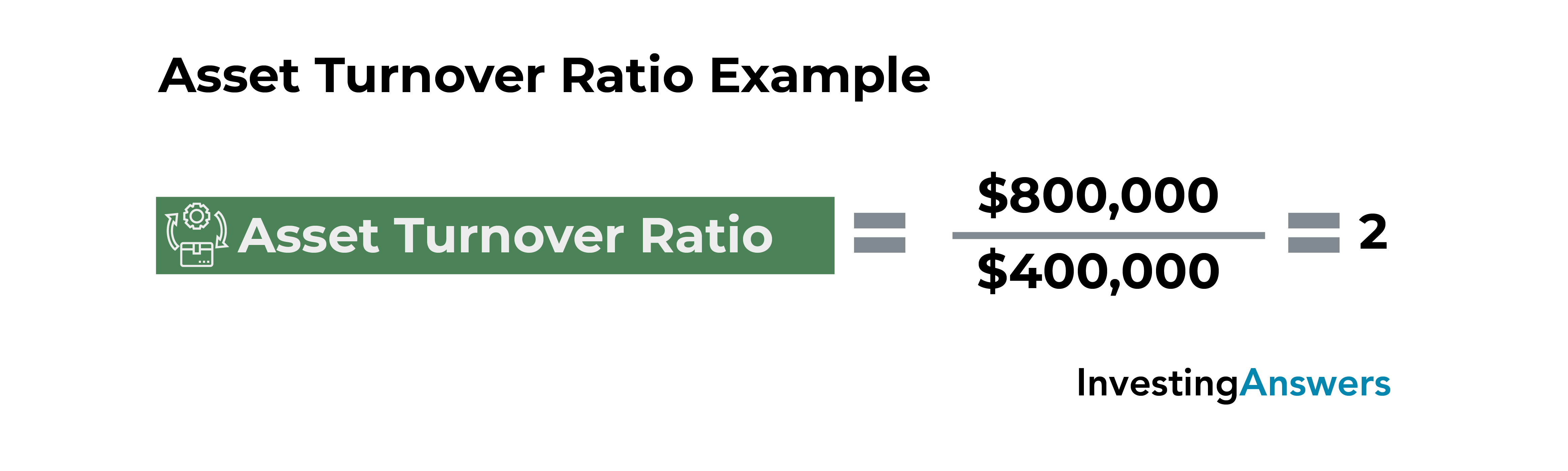

Conversely, a lower ratio may suggest underutilized assets or inefficiencies in operations. This ratio is particularly useful for comparing companies within the same industry, as it can highlight differences in management effectiveness. The asset turnover ratio measures how effectively a company uses its assets to generate revenues or sales. The ratio compares the dollar amount of sales or revenues to the company’s total assets to measure the efficiency of the company’s operations. To calculate the ratio, divide net sales or revenues by average total assets.

In as much as this is considered a low ratio, it is not a bad thing because of the business sector that these companies belong to. Similarly, investors will be very interested in the result of this accounting formula. As a startup seeking early-stage investment, if your company has low revenue, venture capitalists will be taking a gamble on you. Retailers, for instance, may experience high asset turnover during peak shopping seasons and lower turnover during off-peak times. Analysts should consider these seasonal trends to avoid misjudging a company’s performance based on a single ratio snapshot.

The total asset turnover ratio is a general efficiency ratio that measures how efficiently a company uses all of its assets. This gives investors and creditors an idea of how a company is managed and uses its assets to produce products and sales. The asset turnover ratio can also be analyzed by tracking the ratio for a single company over time. As the company grows, the asset turnover ratio measures how efficiently the company is expanding over time; especially compared to the rest of the market.

The asset turnover ratio measures the efficiency of a company’s assets in generating revenue or sales. It compares the dollar amount of sales to its total assets as an annualized percentage. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets. One variation on this metric considers only a company’s fixed assets (the FAT ratio) instead of total assets. The asset turnover ratio is an efficiency ratio that measures the ability of a company to generate revenue from its assets by comparing the company’s net sales with its average total assets. The asset turnover ratio interpretation can be used as an indicator of a company’s efficiency in using its assets to generate revenue.

That is, an interpretation of an asset turnover ratio of 1.5 would mean that each dollar of the company’s assets generates $1.5 in sales. Asset turnover ratios vary across different industry sectors, so only the ratios of companies that are in the same sector should be compared. For example, retail or service sector companies have relatively small asset bases combined with high sales volume. Meanwhile, firms in sectors like utilities or manufacturing tend to have large asset bases, which translates to lower asset turnover. The fixed asset turnover (FAT) is one of the efficiency ratios that can help you assess a company’s operational efficiency. This metric analyzes a company’s ability to generate sales through fixed assets, also known as property, plant, and equipment (PP&E).